Notes: June 14, 2025

What's the real value of my startup?

Startup Valuation Methods: 8 Approaches Investors Use

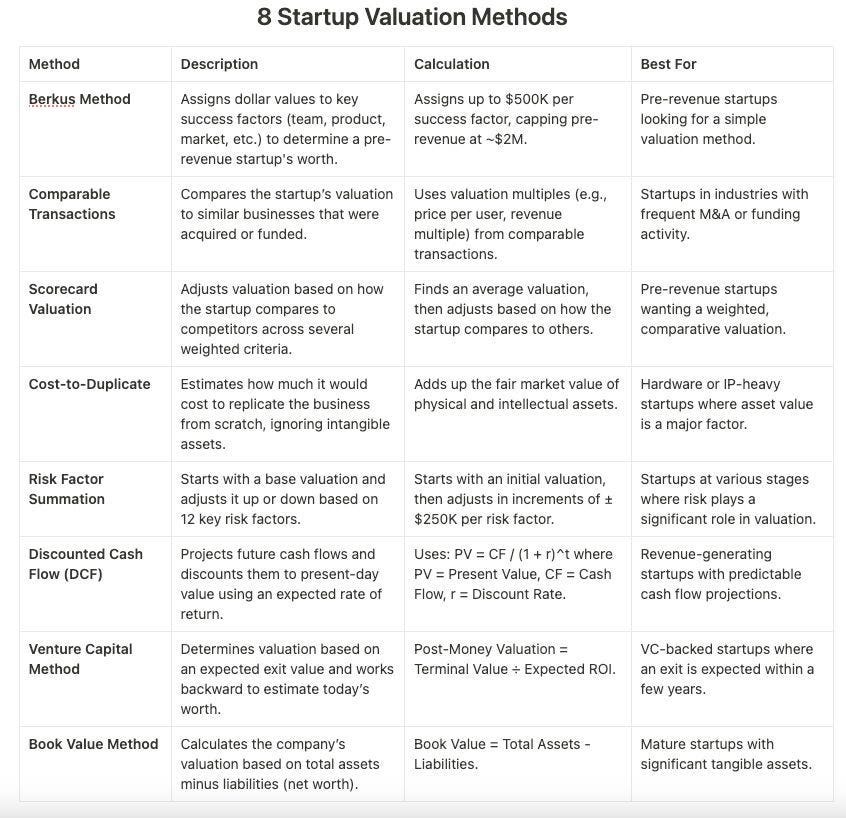

The Berkus Method: Valuing Potential Over Revenue

Here’s how it works: investors break your startup into five categories — the idea itself, the strength of your team, how far your product has come, the product’s launch readiness, and any strategic relationships you’ve lined up.

Each category is assigned a dollar amount, often up to $500K each. Add them together, and that’s your pre-money valuation.

Founder tip: Use Berkus as your early narrative, not your final pitch.

Comparable Transactions: The Startup "Comps" Approach

This is one of the most common methods used by VCs, bankers, and acquirers, and for good reason.

Find relevant deals, extract the valuation multiples (like revenue or user-based), and apply them to your own numbers. For example, if SaaS startups at your stage are getting 8× ARR and you’re doing $2M ARR, your implied value might sit around $16M.

But here’s the catch: good comps are hard to find.

Founder tip: Use comps as a credibility tool, not a crutch.

Scorecard Valuation: Adjusting for Local Strengths

What’s the going rate for startups like yours in your region? If most pre-seed rounds in your city are getting $3 million pre-money, that becomes the baseline.

From there, investors adjust up or down based on how your startup stacks up against others in key areas, like team quality, market size, product, traction, and competitive landscape. Each factor has a weight. Maybe the team counts for 25%, the market size for 20%, and so on. If your team is stronger than average, that part gets a boost. If your go-to-market looks weak, that portion might get docked. According to Eqvista, some of the most common scorecard criteria are:

Board, entrepreneur, the management team – 25%

Size of opportunity – 20%

Technology/Product – 18%

Marketing/Sales – 15%

Need for additional financing – 10%

Others – 10%

Founder tip: Have your data ready; know the average valuation in your area and stage.

Cost-to-Duplicate: Rebuilding from Scratch

This method asks a basic but important question: how much would it cost to build your startup from the ground up, today?

The Cost-to-Duplicate approach estimates the value of your business by adding up everything it took (or would take) to recreate it. That includes engineering time, salaries, tech infrastructure, R&D, hardware, patents, and other tangible investments.

Founder tip: Calculate your cost to build and have it handy. It’s a good fallback if investors push back on price. But don’t stop there. Anchor the conversation in traction, market size, and vision to push beyond the minimum.

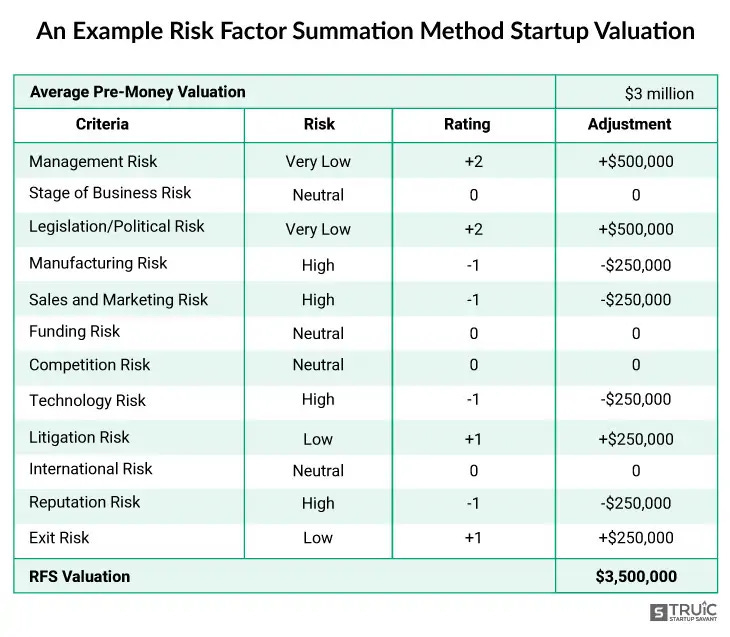

Risk Factor Summation: Quantifying Uncertainty

This method takes a structured approach to something every investor already does - assess risk. The Risk Factor Summation Method starts with a base valuation, often the average pre-money for startups at your stage, and adjusts it up or down based on 12 specific risk categories.

Founder tip: Ask which risks matter most to an investor. If you can mitigate or reframe those concerns, you may be able to shift the math in your favor.

Discounted Cash Flow (DCF): The Financial Forecast Model

one of the most rigorous valuation methods out there. It’s built on a simple idea - a business is worth the money it will generate in the future, adjusted for the risk of actually getting there.

This method is great for startups with steady revenue and visibility into growth, typically post-Series A or later. But in early-stage deals, DCF often falls apart.

Founder tip: DCF can help you understand the long-term economics of your model.

Venture Capital Method: Exit-Driven Estimation

The Venture Capital Method works backward from the endgame. It starts with a projected exit, through acquisition or IPO, and calculates how much a VC needs to invest today to hit their target return.

6 steps:

Estimate the Investment Needed

Forecast Startup Financials

Determine the Timing of Exit (IPO, M&A, etc.)

Calculate Multiple at Exit (based on comps)

Discount to PV at the Desired Rate of Return

Determine Valuation and Desired Ownership Stake

Founder tip: Know the math investors are doing behind the scenes. You can’t control their return targets, but you can influence the exit assumptions. Make a credible case for why your business could be a $100M+ outcome, and back it up with market logic.

Book Value Method: Net Worth of the Startup

This one’s as old-school as it gets. The Book Value Method calculates your startup’s value by subtracting liabilities from assets, essentially, what the company is worth on paper if it shut down today.

Founder tip: Don’t lead with book value unless your assets are a real part of the story. But make sure your books are clean

(Ruben Dominguez Ibar / June 14, 2025 / The VC Corner / permalink)